Solar Energy Stocks… a good investment bet???

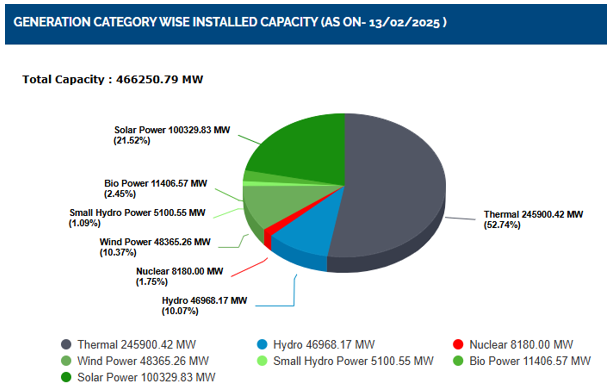

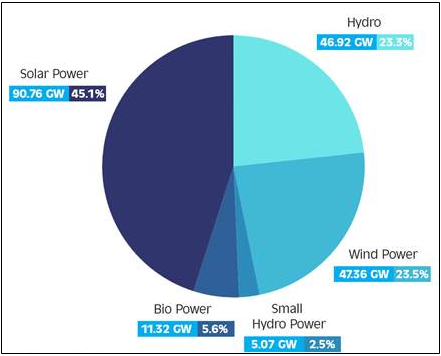

India – the 3rd largest electricity consumer, globally, is also the 3rd largest renewable energy producer in the world with 46.3% of the installed energy capacity - 203.18 GW of 452.69 GW (as of October 2024) - coming from renewable sources [1, 2]. Over last 1 year or so, the total installed capacity for renewable energy in India surged by an impressive 13.5% or 24.2 GW to reach 203.18 GW in October 2024 from 178.98 GW reported in October 2023. In addition to this, when nuclear energy is taken into consideration, India's total non-fossil fuel capacity increased from 186.46 GW in 2023 to 211.36 GW in 2024 [1]. According to CRISIL, 17 out of the 19 GW renewable capacity that was executed in FY24, was solar [3].

Figure 1: Power Generation Capacity in India [4]

This is the era of focus on sustainability. The threat of global warming is very real and gradually gaining volume. All across the globe, countries are increasingly turning to renewable sources to cut down emission and reduce carbon footprint in a desperate attempt to limit further adverse impact of globalization and industrialization. The damage is grave and has already been done. All we are trying to do is limit further deterioration of the situation if not make it better…. whether or not the efforts by countries would be futile is a different discussion altogether.

Our discussion concentrates on the Indian energy landscape which has undergone a sea change with its focus shifting on to the renewable sources of energy to address the growing energy demand that is being fuelled by increasing population, climatic changes caused by global warming, greater urbanization, higher industrialization, technological progress, digitization and digitalization, and growing investment on infrastructure building. There are quite a few renewable sources such as the wind, the sunlight, the rivers and nuclear power. Renewable, because mother nature continuous replenishes their supply unlike the fossil fuels that would take centuries to get replenished. Of these, solar power is of particular interest to us.

A 30-fold surge has been witnessed in solar power adoption. The installed capacity has expanded to nearly 94.16 GW (as of November 2024) from a mere 2.5 GW a decade ago. The government is committed towards creating a sustainable world and scaling up solar capacity. It has taken such initiatives as the International Solar Alliance that reflects India's potential to harness solar power in collaboration with over 120 signatory countries [5].

Figure 2: Renewable Energy Capacity in India as of 10.10.2024

A unique scheme to boost solar power adoption is the implementation of Rooftop Solarization. This scheme encourages installation of residential rooftop solar with Central Financial Assistance (CFA) of 60% of system cost for 2 kW systems and 40% of additional system cost for systems between 2 to 3 kW capacity [6].

This scheme while allowing the households to save on electricity bills will let them earn additional income through sale of surplus power to DISCOMs. A 3kW system will be able to generate, on an average over 300 units per month for a single household. Think about the potential power generation capacity.

The proposed scheme will result in addition of 30 GW of solar capacity through rooftop solar in the residential sector, generating 1000 BUs of electricity and resulting in reduction of 720 million tonnes of CO2 equivalent emissions over the 25-year lifetime of rooftop systems. It is estimated that the scheme will create around 17 lakh direct jobs in manufacturing, logistics, supply chain, sales, installation, O&M and other services.

Investing in the Sector

As an investor you would not want to miss the train. This sector is bound to see significant growth. But there will be a time lag – between construction and operation - just like any other infrastructure sector. Returns come several months after investments.

For lay investors like us, we don’t put money directly into the projects. We are more interested in companies that own these projects and related companies. The best way to do that is through shares and mutual funds.

Investment through Equity

There are several listed companies on the Indian bourses that are in this sector. All you need is to have a bank account and a demat and trading account and you are good to go. Nowadays, thanks to technology, you can trade online from the comforts of your home. There are companies of various ratings according to financials and other parameters. You can use websites such as Screener.com and Monetcontrol.com to study the companies before investing.

But keep in mind that Solar Energy, or any other renewable for that matter, is a theme that will play our in the long term. There is no denying the fact that Indian has embarked on energy transition; but it is also a fact the process is time consuming. While adoption has already started yet there is a long way to left to cover and where there is time involved, there is always uncertainty involved and time value of money make an investor demand higher growth rate for longer term investment. Given the market conditions, the geopolitical turmoil and the general economic condition, risks have been heightened for long terms investments and caution is always advised.

Mutual funds investing in Solar Energy

For those who want to invest without having to take the trouble of putting their heads into research and figuring out which stocks to invest in, there is always the option of investing in Mutual Funds. It offers the luxuries of professional management of your portfolio.

There are several reputed fund houses who have MF portfolios that invest in energy stocks. Some are dedicated energy portfolio. You can pick and choose the one that serves your purpose. You can purchase online or contact relationship managers for assistance.

Energy funds, such as SBI Energy Opportunities Fund, Tata Resources & Energy Fund, DSP Global Clean Energy Fund, etc., that focus specifically on renewable energy are crucial for investors who are interested in sustainable investment options that contribute to environmental conservation while potentially offering attractive returns, reflecting the growing trend and importance of renewable resources in global markets. It may be a good idea to look at thematic energy funds.

Thematic energy funds refer to the type of equity mutual fund that focuses on particular sectors within the domestic energy space. These funds mainly invest in companies across critical sectors such as power, oil, gas, and green energy including solar and wind, as also certain associated industries such as transformers and cables. Investors focusing on this trending theme, can choose the good quality energy mutual funds for potential high growth with a long-term perspective [7].

A Few Things to Keep in Mind

- Energy Funds are well suited for investors who are aggressive and have a long-term horizon.

- Annual return on Energy Mutual Funds at present is 13.3%. The Average Annualised Return over 3 years is close to 21%. High return will always entail high risk.

- The Energy Thematic Funds, therefore, carry risks that are somewhat augmented by their focused nature.

References

[1] PIB, "India's Renewable Energy Capacity Hits New Milestone | Ministry of New and Renewable Energy," 12 Nov 2024. [Online]. Available: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2073038.. [Accessed 17 Feb 2025].

[2] A. Koundal, "India’s renewable power capacity is the fourth largest in the world, says PM Modi | ET EnergyWorld," 26 Nov 2020. [Online]. Available: https://energy.economictimes.indiatimes.com/news/renewable/indias-renewable-power-capacity-is-the-fourth-largest-in-the-world-says-pm-modi/79430910.. [Accessed 17 Feb 2025].

[3] CNBC TV18, "17 Out Of The 19 GW Renewable Capacity Executed In FY24 Was Solar: CRISIL Ratings," 18 Feb 2025. [Online]. Available: https://www.cnbctv18.com/binge/awaaz/-out-of-the--gw-renew-sb0x1rxSFEk.htm. [Accessed 18 Feb 2025].

[4] National Power Portal, "Installed Capacity," 13 Feb 2025. [Online]. Available: https://npp.gov.in/dashBoard/cp-map-dashboard.. [Accessed 17 Feb 2025].

[5] Invest India, "Investment Opportunities in Renewable Energy," Dec 2024. [Online]. Available: https://www.investindia.gov.in/sector/renewable-energy.. [Accessed 17 Feb 2025].

[6] GoI - Ministry of New and Renewable Energy, "Cabinet approves PM-Surya Ghar: Muft Bijli Yojana for installing rooftop solar in One Crore households," 29 Feb 2024. [Online]. Available: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2010133.. [Accessed 17 Feb 2025].

[7] MySIPOnline, "Energy Mutual Funds," 2025. [Online]. Available: https://www.mysiponline.com/mutual-funds/thematic-energy.. [Accessed 18 Feb 2025].