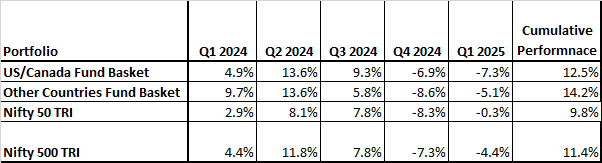

The early part of 2024 was marked by strong economic growth, robust corporate earnings, and a bull market that seemed unstoppable. However, the latter half of the year painted a contrasting picture, with increased volatility and market corrections. Despite these fluctuations, the Nifty 500 TRI delivered a solid 16.5% return in calendar year 2024, and 11.36% over the 15-month period ending March 2025, starting from January 2024—the inception point of our curated fund baskets.

During this same period, both the US/Canada and Non-US Fund Baskets consistently outperformed the benchmark, reaffirming the strength and strategic positioning of our portfolios.

Amid this dynamic market environment, mutual fund industry veteran Ritesh Jain, in partnership with Eastern Financiers—one of India’s premier wealth management firms—launched NRIZEN.com. This platform is tailored specifically for Non-Resident Indian (NRI) investors, offering curated mutual fund portfolios crafted to navigate diverse market conditions and capitalize on macroeconomic trends.

A Strategy Rooted in Macro Themes

Ritesh Jain’s fund selection is informed by his deep macroeconomic insights, with a strong focus on high-growth themes such as:

- Rising nominal GDP

- Import substitution

- Growth in the manufacturing sector

- Expansion in electronics and alternative energy

Unlike conventional diversified equity mutual funds—often skewed toward India’s service sector— Ritesh Jain’s portfolios emphasize India’s manufacturing renaissance, aligning with the country's broader economic pivot.

Strong Performance and Consistent Returns

NRIZEN offers two distinct fund baskets:

- One for NRIs based in the US and Canada

- Another for NRIs residing in other parts of the world

As of December 31, 2024, both portfolios have delivered over 20% year-to-date (YTD) returns, consistently outperforming the Nifty 500 in nearly half the months throughout the year.

Over the 15-month period since inception, the portfolios have outpaced the benchmark by more than 1%, a solid performance considering the global financial turbulence during the same timeframe.

In the first quarter of 2025, the portfolios saw slight underperformance relative to the Nifty 500, primarily due to short-term market corrections.

Quarterly Returns

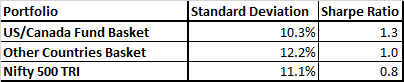

Risk-Adjusted Returns

In 2024, NRIZEN’s curated fund baskets didn’t just beat the benchmark on absolute returns—they also outshone on a risk-adjusted basis, as seen in the Sharpe Ratios:

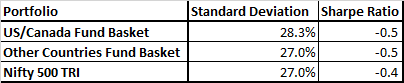

Year 2025 –

Outlook: Long-Term Confidence Amid Short-Term Noise

While markets may continue to experience volatility in the near term, driven by profit-taking and global interest rate uncertainties, the long-term fundamentals supporting these curated portfolios remain strong.

Whether you're an NRI, OCI holder, or even a resident Indian investor looking for macro-aligned opportunities, you can explore and invest in these top-performing portfolios through NRIZEN.com.