Non-resident Indians (NRIs) often seek investment opportunities in their homeland in a bid to secure their financial stabilities. The Indian market offers a range of investment options including equities, mutual funds, fixed deposits, and debt funds, that presents promising opportunities for wealth creation.

Mutual fund market in India offers a workable investment opportunity for NRIs that holds promises of lucrative return. Mutual funds offer the best investment option for the simple reason that the investor only has to purchase the units of the Fund and do not have to manage the individual investment components as in equity or debt investment. That is taken care by professional experts called the Fund Managers. They will toil to deliver the market returns promised. As an investment option Indian MFs offer the benefits of superior returns along with diversification, being an ideal vehicle to park funds for long-term growth.

Mutual fund market in India offers a workable investment opportunity for NRIs that holds promises of lucrative return. Mutual funds offer the best investment option for the simple reason that the investor only has to purchase the units of the Fund and do not have to manage the individual investment components as in equity or debt investment. That is taken care by professional experts called the Fund Managers. They will toil to deliver the market returns promised. As an investment option Indian MFs offer the benefits of superior returns along with diversification, being an ideal vehicle to park funds for long-term growth.

The ABCs of Investing in MFs

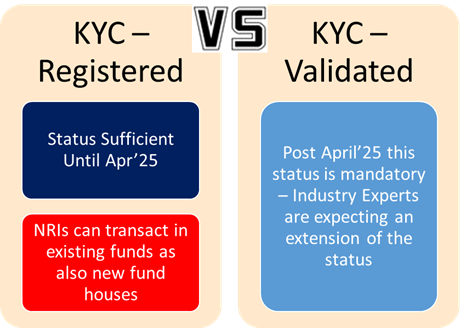

As of now, NRIs have the option of investing with a 'KYC registered' status until April’25. All NRI investors need to upgrade their KYC status to 'KYC validated' by April’25 in order to be able to invest. Experts expect to see an extension of the deadline. NRIs must provide an Aadhaar card as proof of address towards this end.

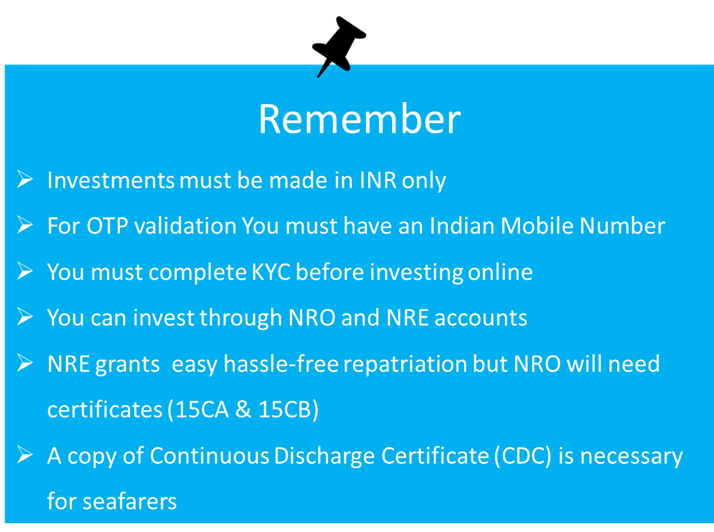

NRIs must have a Non-Resident Ordinary (NRO) or a Non-Resident External (NRE) bank account with an Indian bank to invest in Indian mutual funds, as AMCs cannot accept foreign currency investments. All investments by NRIs are made in Indian Rupees.

NRIs can choose to invest in mutual funds in India either

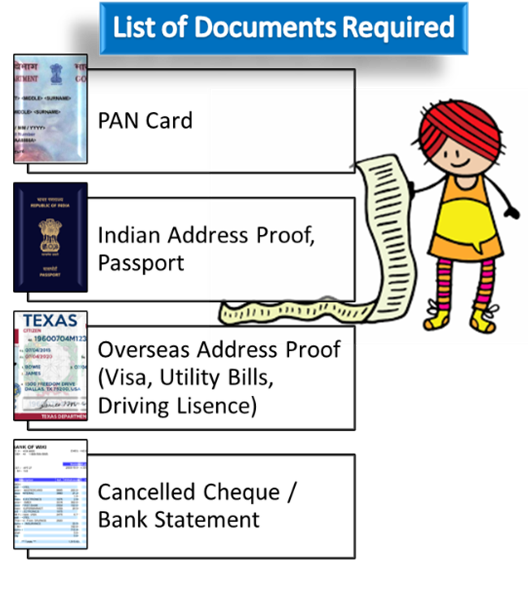

- Directly by submitting their application and the required Know Your Customer (KYC) documents. (May require physical verification, for which the NRI must visit the Indian embassy in respective country of residence with the relevant documentation).

OR - Indirectly using Power of Attorney (PoA) assigned to a trusted individual in India for making investment decisions on their behalf. (Requires the signatures of both the NRI and the PoA on all KYC documents).

Documentation & Regulatory Compliance

- KYC Compliance: Documents that are Indispensable for KYC include a passport copy, PAN card, recent photograph, bank statement, and an address proof.

- FEMA Regulations: Investments must comply with the Foreign Exchange Management Act (FEMA), that mandates a declaration from NRIs confirming adherence to Indian regulations.

- Foreign Inward Remittance Certificate (FIRC): MF investments necessitate payments be made using cheques or demand drafts, accompanied by an FIRC that will verify the source of funds.

- Redemption Process: The proceeds (post-tax) received, on maturity of an MF investment or exit from it, get credited to the NRE/NRO. For non-repatriable investments, proceeds go to an NRO account only.

- FATCA compliance: The Foreign Account Tax Compliance Act (FATCA), effective from January 2016, mandates all Indian and NRI investors to file a FATCA self-declaration.

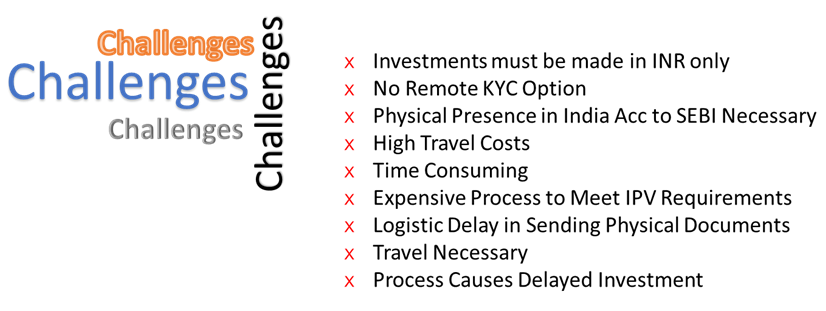

There are certain challenges that the NRIs face while investing in Indian MFs. At present, there is no provision for NRI investors to remediate KYC online. It is constrained by the limitations of using Aadhaar-based process within Indian territory only. Hence, they need to undergo the KYC process by submitting documents physically, which makes the procedure tedious as well as lengthy and costly. This can cause delay in investments and may sometimes prove to be an inhibitor.

Having an active Indian mobile number is also necessary. Currently, overseas mobile numbers of NRI investors aren’t being validated by KRAs, hence, KYC status cannot be 'On-hold'. However, there is no such restriction for email addresses. KYC status can be updated as 'KYC On-hold' in case the email ID of an NRI investor is not getting validated.

To Conclude

If you are an NRI trying to invest in Indian MFs, you have to bear the hassles physical of KYC. There’s no paperless alternative. Also, make sure you have access to a plan that suits your needs. Invest in a fund and a fund manager you trust – a fund that features high on the list of funds having the reputation of being professionally and efficiently managed. Compromising on customisation or human expertise can disrupt your investing and wealth creation journey, and this should be non-negotiable. Compromising can mean delay or non-achievement of your target.

Sources: