2024 has been a very engaging year for the Indian stock market. While the broad trend of the market has been bullish, there have been periods of volatility in certain sectors and even in the broad market. Nifty 50 gave 18.71% return while the broader market outperformed Nifty (Nifty 500 was up 24.53%).

At the beginning of this year, mutual fund industry veteran Ritesh Jain and Eastern Financiers, one of the leading wealth management firms in India launched www.nrizen.com curated funds’ portfolios for Non-Resident Indian (NRI) investors. Ritesh selected funds in his model portfolios for NRI investors based on his broad macro views which focused on the following themes, which could create alphas in investors’ portfolios: -

- High nominal GDP

- Import substitution

- Manufacturing

- Big push to electronics and alternate energy

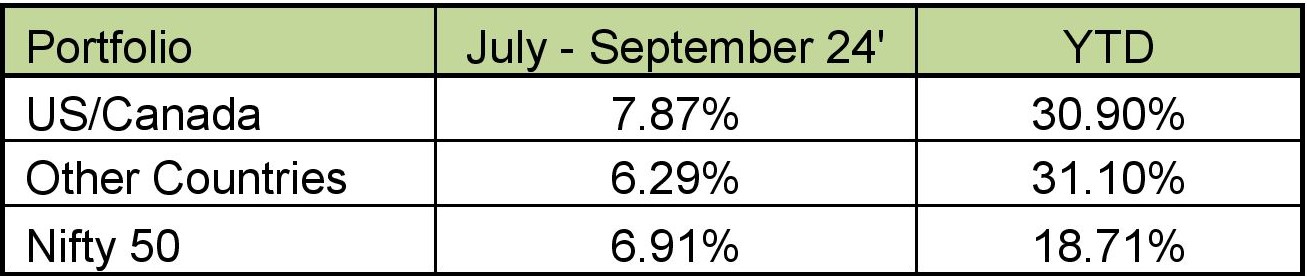

Traditional diversified equity mutual fund schemes still have a tilt towards service sector which account for more than 50% of India’s GDP. However, Ritesh has strong conviction in manufacturing led India Growth story. Funds curated by him have a pronounced manufacturing tilt. Ritesh has developed two fund baskets (portfolios) with his curated funds, one for US / Canada residents and one for NRIs in other countries. Both the curated funds’ portfolios have given 30%+ YTD returns (as on September 30th 2024) beating the broad market index Nifty 50 on a YTD basis.

The performance of Ritesh Jain’s fund basket, with 80 – 90% of the curated funds beating their benchmarks, is even more impressive when compared to the performance of the universe of diversified equity mutual funds in India, where only 60% or so of the funds were able to beat their benchmarks. The performance of our model portfolios across different market conditions strengthens conviction in Ritesh Jain’s investment theme. Investors should be prepared for some volatility in the near term due to profit booking at higher levels and uncertainty regarding timing of interest rate cuts. However, we remain confident that model portfolios will continue their strong performance and create alphas for investors in the long term.

Investors (both resident Indians / Non-resident Indians / OCI’s) looking to invest in Ritesh Jain’s Model portfolio of Indian mutual funds can register at nrizen.com and invest online through the portal.