Over the years, Systematic Investment Plans (SIPs) offered by mutual funds have become a household name in India. Their growing popularity among investors is evident from the steady increase in monthly SIP contributions, as shown in the graph below.

Given this rising interest, investors often have several questions regarding SIP investments. This study, conducted by WhiteOak Capital Mutual Fund, seeks to answer some of the most commonly asked questions based on long-term market index data.

Q1: What Is an Ideal Investment Time Horizon for SIP?

Equities have historically been a volatile asset class. However, the study reveals that volatility decreases as the investment horizon increases.

Key findings: 100% Positive Returns for Long Horizons: Investors who maintained SIPs for eight years or longer saw positive returns 100% of the time (%XIRR rolling returns for BSE Sensex TRI, September 1996 to December 2024).

High Returns for Extended Periods: SIP investors with horizons of ten years or more earned returns of over 10% approximately 95% of the time.

Conclusion: The longer the investment horizon, the higher the probability of receiving stable and decent returns.

Q2: Which Is Better: Starting SIP at the Market Peak or Bottom?

Consider the following scenarios for a monthly SIP of Rs. 10,000 in BSE Sensex TRI:

Scenario 1: Starting at Market Peak (January 2008)

Total Investment: Rs. 20.4 Lakh

Value as of December 2024: Rs. 72.1 Lakh

XIRR: 13.5%

Scenario 2: Starting at Market Bottom (March 2009)

Total Investment: Rs. 19.0 Lakh (Rs. 1.4 Lakh less)

Value as of December 2024: Rs. 61.7 Lakh (Rs. 10.5 Lakh less)

XIRR: 13.6%

Key Insight: The "Cost of Delay" for starting a SIP late can be significant over the long term. The longer it takes for the market to reach its bottom, the higher this cost becomes.

Q3: Is It Better to Time Monthly SIP Investments?

Timing the market consistently is virtually impossible. While hindsight may tell us the best days to invest, predicting market levels with certainty in advance is not feasible.

% XIRR for BSE Sensex TRI for SIP between September 1996 to December 2024.

Q4: Which Date Should You Select for Monthly SIP?

A historical analysis of daily rolling returns from September 1996 to December 2024 for BSE Sensex TRI shows that the specific SIP date has minimal impact on long-term returns.

Q5: Which SIP Frequency to Select?

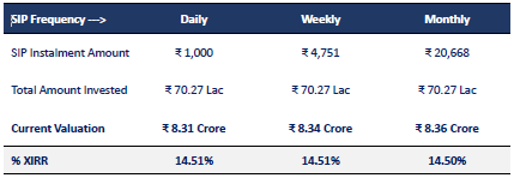

Historical data suggests that in the long term, the frequency of SIP investments (daily, weekly, or monthly) makes little difference. All frequencies tend to generate similar returns when total investments are equal.

Findings: % XIRR for BSE Sensex TRI between September 1996 to October 2024, with SIP instalment amounts adjusted to keep total investments constant across frequencies.

Conclusion: Investors can choose any frequency (daily, weekly, or monthly) based on convenience without worrying about compromising returns.

This comprehensive study underscores the importance of starting SIPs early, maintaining a long-term investment horizon, and focusing on disciplined investing rather than attempting to time the market.

Credit: WhiteOak Capital Mutual Fund

Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Investments in securities market are subject to market risks, read all the related documents carefully before investing.

AMFI Registered Mutual Fund Distributor